Owning Vs Renting

The monthly cost of buying a home has significantly increased with the rise of interest rates and housing prices. I have a lot of people asking Is it worth buying now or should I wait until rates dip or prices pull back?

For those who already own a home and looking to upgrade, it’s definitely tough to go from that locked in 3% mortgage to a more expensive house at double the interest rate. Maybe you are better off staying put unless you have real need to move. Although, I think this market may create more challenges for higher end sellers, while lower end homes should stay in high demand. So, there could be some good buying opportunities.

Those of you who are first time home buyers should weigh your options and future plans. If you are somewhat settled and don’t think you’ll need to move for work or a relationship in the next couple years; it’s probably worth buying. Consider this:

A $350,000 house with 5% down would cost around $2,500/month for mortgage payment, taxes, and insurance (based on Dec 22 6.125% interest). To rent a similar house would be around $2,250/month which of course sounds like a savings. However, 3 years from now the price of rent would exceed your house payment with normal 3-5% rent increases. If you were a homeowner – you’d have $50,000+ in equity by the 3rd year, simply based on the principal paydown of your mortgage and the historic average 4% appreciation rate. As an added bonus, if interest rates dip, you have the opportunity to refinance and lower your mortgage costs.

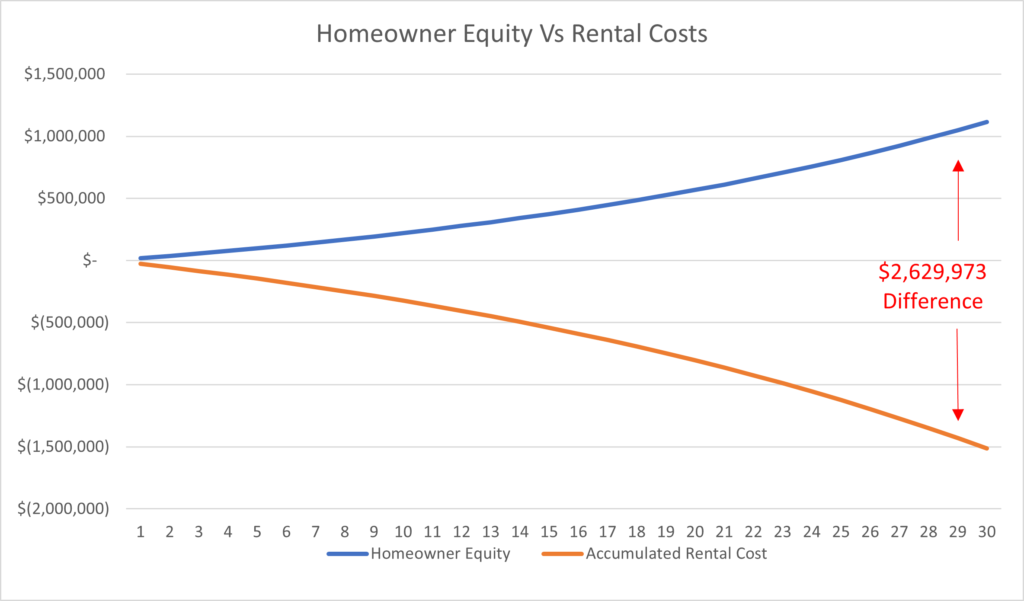

The amount of equity gained has a compounding affect over the years too. If we average 4% appreciation and you only pay minimum payments on your mortgage, you’d have a paid off 1.1 million dollar house at the end of your 30 year mortgage. At the same time a renter would have thrown away $1,514,000 in rent for the same house. The truth is that most people don’t hold a mortgage for 30 years. They either move sooner, pay it off sooner, or refinance and take some equity out. In any case, you can see that homeowners have a huge financial advantage, even just a few years into their home ownership.

The bottom line is if you are first time home buyer with the financial means to buy, I wouldn’t let the interest rates hold you back. Some people are worried the housing market will dip, but I think the fundamentals, demand, and lack of supply in the Madison area are too strong for much of a dip. If it does pull back it will be minimal. If you plan to be in a home for at least 5 years I’m a strong believer that you should buy. You should come out well ahead of renting financially. We are continuing to buy investment properties even in the current environment. Feel free to reach out if you have questions or need help with a strategy to buy, sell, or invest.

Back Home

Back Home