Market Update – 1st Half 2020 Wisconsin & Dane County Stats

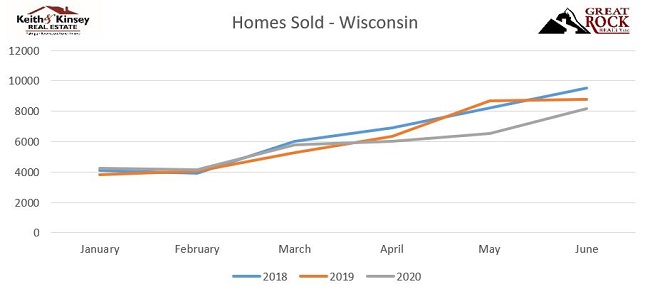

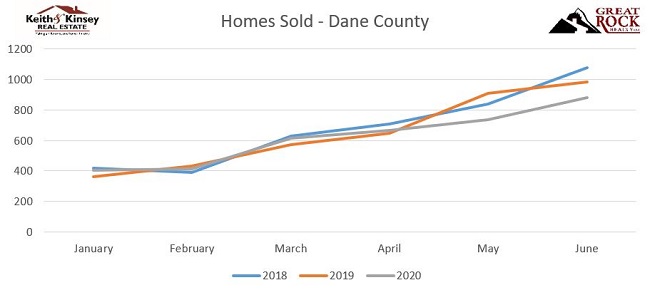

There is no question the first half of 2020 has been strange. COVID-19 really threw a curve ball at the economy and many industries. Much of our state was shut down March thru May, which is normally our busy season (for buyer showings and listings) in real estate. Traditionally, the number of listings and active buyers spikes in these months. Since closings are often 30-60 days after an accepted offer, this results in June being the typical peak month of home sales in Wisconsin.

2020 is a different story. In much of March and the first part of April people stayed home, and potential home sellers didn’t want others in their home (so they didn’t list). By the 2nd half of April buyers started getting active again, but inventory was extremely tight. By the end of May Wisconsin had opened up again, and the flood gates seemed to let loose. It was like the Spring market just came 2 months later than normal.

You can see from the charts below that sales (closings) were significantly down over last May (-19.2% in Dane County and -24.4% statewide) and June (-10.5% in Dane County and – 6.8% statewide) due to the slower March and April.

The good news is, this doesn’t seem like it will be the trend for July and August, and my prediction is that July and August will make up for fewer sales in May and June. Great Rock Realty’s numbers are on pace for our best July and August ever, based on number of homes closed, and I’m sure other brokerages in the area are experiencing the same thing.

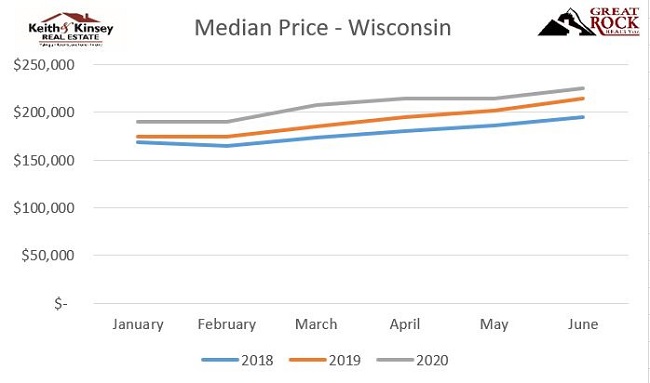

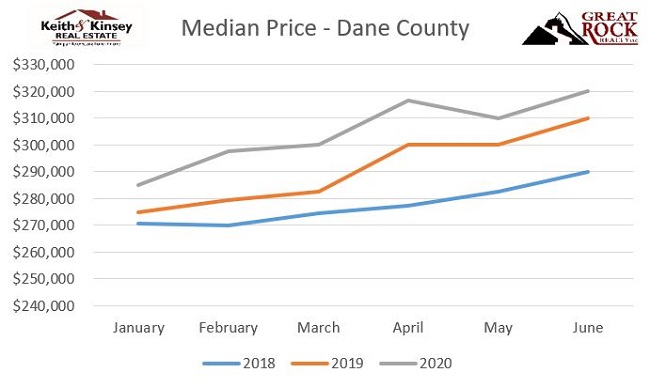

Price-wise, median prices are tracking as the should just slightly higher than last year (+3.9% in Dane County and +4.9% statewide). I’d predict we’ll see a bit of a spike in these numbers of July and August as well, because there have been lots of bidding wars happening in May and June thus far.

Overall, this is great news for the housing market considering the circumstances. It seems the Corona virus pandemic has had little impact on housing overall. In Wisconsin and Dane County, we’ve remained relatively stable. As for the rest of the economy, I can’t speak to that, only time will tell. If it does come crashing down again, I don’t think the next crash will be housing driven like 2008.

Back Home

Back Home