Being Conservative With Your Mortgage

I’m a big believer in living debt free. Living without debt offers you more freedom, less stress, and a more stable life. Although, it’s pretty rare that someone has saved up enough cash to buy a home (good work if you have). A mortgage is one of the few debts I don’t think is totally stupid. You can lock in your cost of housing with a mortgage while at the same time your property is rising in value (I know it’s hard to believe after recent years, but the long term trend is still upward). Continuing to rent means your cost of housing could go up every year.

Assuming you need a mortgage to buy a home, I’d suggest buying a home that is not stretching your financial limits. You don’t want to be house poor sticking every penny you make into your home. My suggestion is to target ¼ of your total household income or less for your house payment. If you are married with two incomes, try just qualifying for your mortgage based on one income. Being a bit conservative with what you borrow will allow you to pay extra on the mortgage in months that you have extra money in the budget, and you won’t be stretched in those months where cash is tighter.

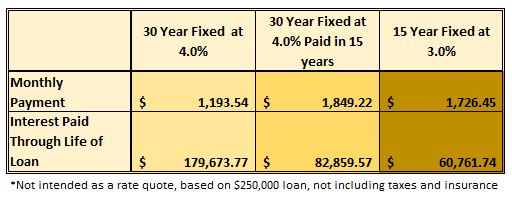

The quicker you can pay off your mortgage the less you will pay in interest. The chart below shows what you would pay for interest in 3 different payment scenarios based on a $250,000 loan. Kinsey and I personally chose the middle option. We did a 30 year fixed rate mortgage to allow the flexibility of the lowest payment possible since we have an extremely variable income, and we knew having children would throw a curveball at our income and spending. However, we’ve been working hard to pay off our mortgage in less than 15 years. Many people aren’t disciplined enough to pay extra on the mortgage, if that’s you, than maybe the 15 year mortgage is your best option. You can see that an extra $533/month on a 15 year mortgage saves you $ 118,912.03 in interest over the life of the loan! Wow!

The bottom line is you will enjoy your home and your life much more if you aren’t stressing out over every penny every month just to make the payments. Use your common sense to determine what is right for you. I guarantee you will be happier with a bit less house, but a lot less stress.

Back Home

Back Home