How to Pay Off Your Mortgage Fast

I hear so many people that talk like it’s impossible to pay off a house, or they expect to be in debt the rest of their lives. Well, quite the contrary, it’s entirely possible to have a paid for house. You just have to be really dedicated to getting out of debt and make it a priority.

I hear so many people that talk like it’s impossible to pay off a house, or they expect to be in debt the rest of their lives. Well, quite the contrary, it’s entirely possible to have a paid for house. You just have to be really dedicated to getting out of debt and make it a priority.

How do you do it? How do you pay off your mortgage? Well, it’s really simple, the two key things are:

DON’T BUY TOO MUCH HOUSE – Most REALTORs and mortgage lenders would like you to buy as much home as you can possible afford. Don’t fall for this, or you will be in debt forever. Buy something you can comfortably make the payments on without stretching yourself. With mortgage guidelines loosening again, allowing higher debt to income ratios, it’s more important than every that you ignore what the bank says they’ll loan you and live within your means.

PAY MORE THAN MINIMUM PAYMENTS – Pay more than minimum payments or refinance into a shorter-term loan. This is completely obvious, but very few people do it. You’d be surprised how big of a difference it makes to pay a little extra each month. See the example and explanation below.

Most people have 30 year mortgages, but any 30 year mortgage can be paid off at a faster rate. The only reason you’d want to refinance is if you get a much better interest rate. Shorter term mortgages such as 10, 15, and 20 year mortgages tend to have a lower interest rate than a 30 year mortgage. However, do the math first. Figure out how much you save per month in interest vs how much it costs to refinance. If it takes 5 years of interest savings to pay for your refinance costs it’s probably not worth refinancing, just pay more on your mortgage.

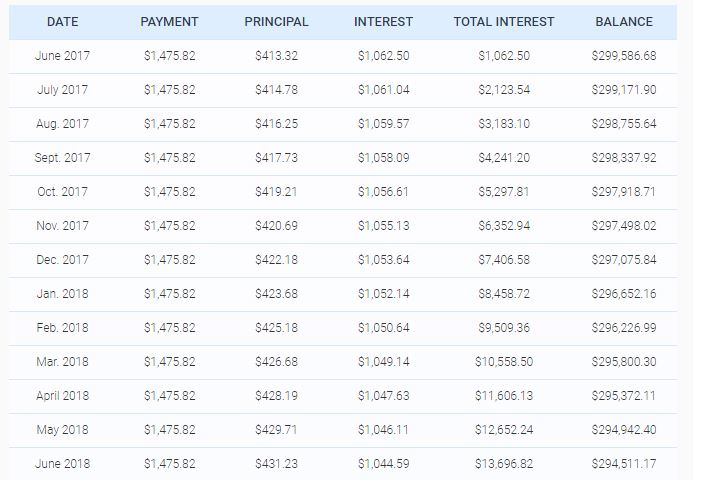

When you look at an amatorization chart, you can quickly see how much savings you get from paying just a little bit extra each month. Make sure your additional payment goes to the principal balance of the loan and is not just a pre-payment. Take for example the first year of a payment schedule on a $300,000, 30 year mortgage, at 4.2%. The chart below shows that of your $1,475.82 payment of principal and interest (excluding taxes and insurance). Only $413.32 of your first payment actually goes to paying off the debt, the rest is interest. This means that if you simply paid an extra $414.78 (the principal for the second month), or a total of $1,890.60 for your first payment, you’ve effectively paid two months’ worth of your loan instead of one month. Or if you could pay $6,120.10 In one month, you’d be paying an entire year of your mortgage and saving $11,589.74 in mortgage interest. Obviously paying thousands extra every month on a mortgage isn’t realistic for most people, but the point I want to make is that a few extra dollars paid toward your mortgage can make a big difference in the end. In the example above, if you were to pay $1,600/month rather than $1,475, you’d knock almost 5 years off your loan, and if you were to pay $1,900/month, you’d knock almost 11 years off your loan.

There are a couple of arguments against paying off your house early. One argument is the tax benefit of deducting your mortgage interest. Don’t get me wrong, deductions are a great help in reducing your tax liability, but does it really make sense to spend $10,000 in mortgage interest to save $3,000 in taxes. NO. Also, this deduction may not always be there. The other argument to not paying off a home is that you can earn a larger return on an investment than you pay in mortgage interest, so you might be better off investing the extra money rather than paying down your mortgage. This is a fair debate, but as financial guru Dave Ramsey points out, that argument does not factor in risk. Once your home is paid for nobody can take it from you (except the government if you don’t pay your taxes). If your employer laid you off tomorrow, it wouldn’t be such a big deal with a paid for house. There is a huge weight lifted off your shoulders when you pay off your home and you gain a sense of financial freedom. Additionally, most people aren’t disciplined enough to actually invest the extra money they could be paying down their mortgage with.

Imagine what it would feel like to own your home free and clear! Imagine the sense of financial strength, security, and stability you’d have if you didn’t have to pay that payment every month. If you want to get that house paid off, just pay a little extra each month. Be a little frugal in some other areas of your life. Instead of wasting that overtime pay on a fancy dinner, put it toward your mortgage. It’s easier than you’d think, and before you know it, you’ll be the proud owner of some debt free real estate.

Back Home

Back Home

Leave a Reply

You must be logged in to post a comment.